New FFIEC Social Media Guidelines for the Banking Industry

On December 11 2013, the FFIEC (Federal Financial Institutions Examination Council) published Social Media: Consumer Compliance Risk Management Guidelines, giving the banking industry its first overview with how social media can be successfully managed in a risk heavy industry. The guidelines do not impose new requirements; rather, they provide clear language on how institutions can operate in the social realm while adhering to existing laws and regulations for compliance and consumer protection. The guidance discusses the risks involved, both in reputation and in operation, in navigating in social.

Due to the increased risks for this industry, the report emphasizes the need for a “risk management program that allows it to identify, measure, monitor and control the risks related to social media.” Further, the document highlights the importance of educating all employees operating social media on behalf of the organization:

“An employee training program that incorporates the institution’s policies and procedures for official, work-related use of social media, and potentially for other uses of social media, including defining impermissible activities.”

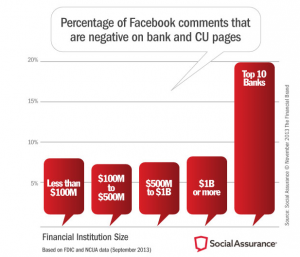

With this detailed social media playbook, there is little excuse for these institutions to not take a stronger hold on their digital and online footprint, especially in managing their social reputation and customer relationships. Industries that elicit emotional reactions like the banking industry, (i.e. MONEY) must develop procedures to respond to the consistent emotional – both positive and negative – reactions that customers have when engaging in online social conversations with their bank or savings institutions. For example, Social Assurance (SMM tool for financial organizations) tracked data on 1.9 million Facebook interactions on banking and credit union pages in Q3 of this year, and stated as a result of their findings:

Although the larger banks received a copious amount of negative feedback as compared to the smaller banks, there are social solutions which these banks and credit unions should take note.

Given the recommendations from the FFIEC report, banks should be creating cross-collaboration teams to provide new processes which support stronger customer engagement (responding to negative feedback) compliance regulation, streamlined procedures and eventually, direct revenue opportunity. Additionally, the need for an advanced infrastructure (tool) that can manage workflow, compliance & governance is now widely recognized by most of the banking industry, as 65% of responding banks plan on adopting new social management technology tools.

The full FFIEC report can be accessed here.

About Emily Trayers

Emily is the COO and SVP of Business Development with SayItSocial, and handles all key accounts while driving the acquisition and support of new clients. She is also one of our lead trainers and speaks at nationwide conferences and panels on the subject of social and digital business.

Like What You Are Reading? Subscribe To Read More

Join our mailing list to receive the latest news and updates from our team.